Blog Series – Unlocking Potential: The Transformative Role of Digital Business Development Services for Micro Enterprises in Developing Countries

Part 2/3 – How to Unlock the Potential (the technical challenge)

In the first blog – the Broken Promise – I discussed how the current situation does not benefit either the Micro Finance Institution (MFI) or microentrepreneur. That the relationship was one of convenience rather than a win-win. However, in today’s rapidly evolving digital landscape, a more symbiotic relationship is possible.

Microentrepreneurs face significant challenges that hinder their growth. Enter Digital Business Development Services (BDS), a game-changer that has the potential to unlock new opportunities by offering a wide array of tools and services designed to empower small business owners and drive sustainable growth at scale, with efficiency while being cost effective.

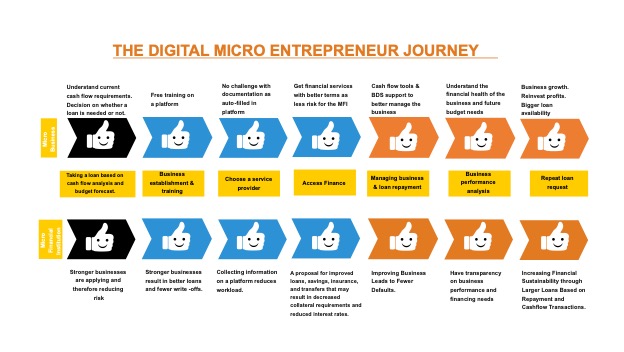

By looking at the microfinance journey, it can be seen there are three distinct phases, 1) decision making on whether a loan is needed, 2) pre-loan & loan application, and 3) post loan disbursal. Therefore, BDS digital tools need to be developed to align to those phases. Through mobile Apps, microentrepreneurs can access relevant resources and support and which should be based around 3 core areas – business training, cash flow management and advisory.

Business management training – What’s the ultimate goal of business training? In many cases, it’s a business plan from which the trainee can follow and where appropriate, provide to an MFI, bank or investor for finance. Therefore, the design of the training should lead to the following outputs: 1) a business plan, 2) financial statements and, 3) a loan application. However, it must keep in mind, 1) diverse business models and, 2) sufficient detail to make a business plan and financial statements stand up under scrutiny.

A cash flow management system – is a crucial tool for monitoring and optimizing the movement of cash in and out of the business. Not only does this help in managing a business, but can assist the entrepreneur in analysing if they need a loan or not. On the other side, if a micro entrepreneur is able to show cash flow records to a MFI, then it reduces the risk (for the MFI) and who can do their analysis on actual data rather than forecasts.

Mentoring/advisory – One-to-one support for micro-entrepreneurs is a significant value add. Within digital BDS, the choice is canned advisory using decision tree logic or AI. There are also a range of relevant support tools which can be used/developed such as self-assessments.

In conclusion, digital BDS emerges as a catalyst for unlocking the potential of micro-enterprises. In the last part of this series, I will discuss some commercial considerations and launch my white paper.

#microentrepreneur, #digital #businessdevelopmentservices #sustainablegrowth #transformation